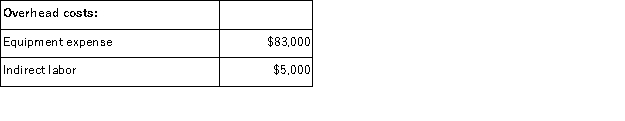

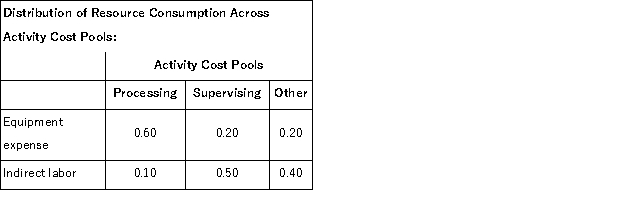

Studler Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other.In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

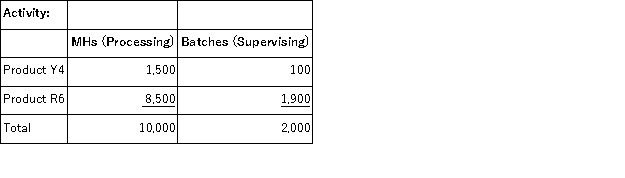

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Intra-entity Gross Profit

The profit recorded from transactions that occur within the same entity, often eliminated in consolidation.

Eliminate Intra-entity Transfer

The process of removing sales and purchases of goods or services made between companies within the same corporate group in consolidated financial statements.

Q12: (Ignore income taxes in this problem. )Clairmont

Q23: Brannum Corporation has provided the following data

Q34: Dreckman Inc.uses a job-order costing system in

Q95: The TS Corporation has budgeted sales for

Q96: Tondre Inc.has provided the following data for

Q97: Lasorsa Corporation manufactures a single product.Variable costing

Q106: Keske Corporation has an activity-based costing system

Q107: Chown Corporation, which has only one product,

Q111: In a factory operating at capacity, not

Q172: Brees Inc. , a company that produces