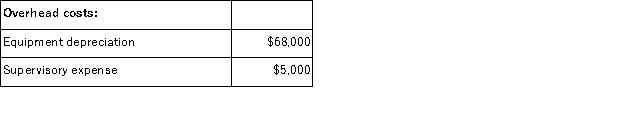

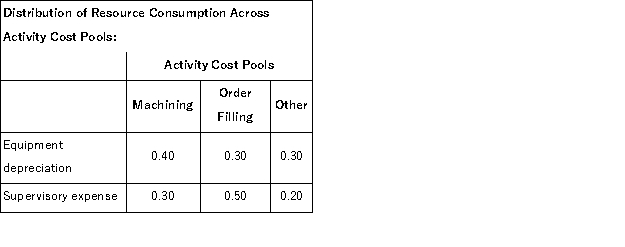

Keske Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other.In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

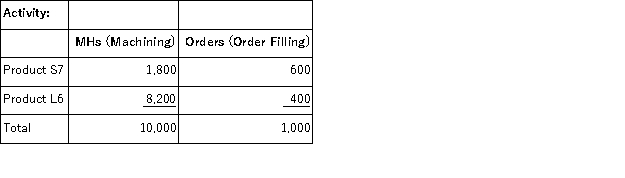

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

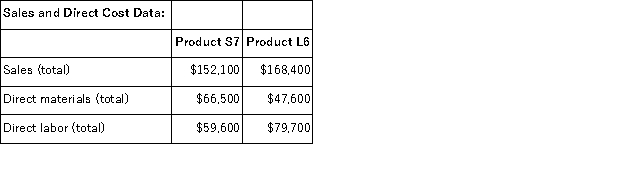

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.  What is the product margin for Product L6 under activity-based costing?

What is the product margin for Product L6 under activity-based costing?

Definitions:

Blended Family

A family composed of a couple and their children from this and all previous relationships, emphasizing the merging of two separate families into one new unit.

HIV/AIDS

A virus (HIV) that attacks the immune system and can lead to the disease AIDS, a condition where the body cannot fight off infections effectively.

Sexually Restrictive

Societies or policies that place strict rules and limitations on sexual behavior and expression.

Nuclear Family

A family unit consisting of two parents and their children, living together as a single household.

Q4: The selling and administrative expense budget of

Q26: Assume a company sells a single product.If

Q48: If the actual manufacturing overhead cost for

Q65: (Ignore income taxes in this problem. )Overland

Q108: If sales volume decreases, and all other

Q113: Hogans Corporation has two divisions: Delta and

Q132: When a company shifts from a traditional

Q134: In activity-based costing, organization-sustaining costs should be

Q143: Clemmens Corporation has two major business segments:

Q162: Cashan Corporation makes and sells a product