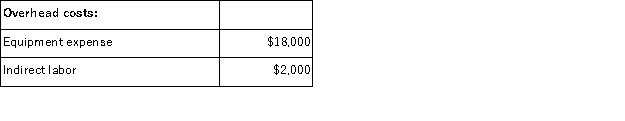

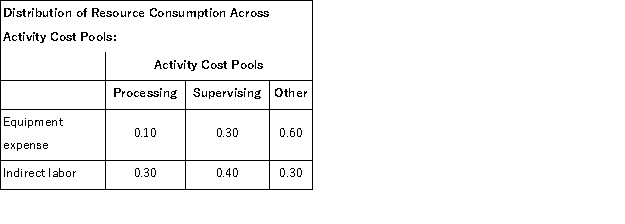

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

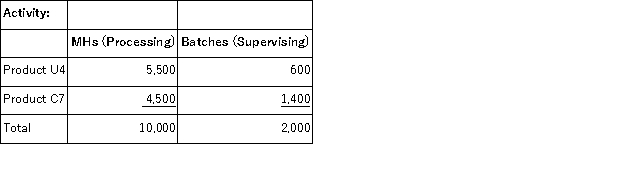

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

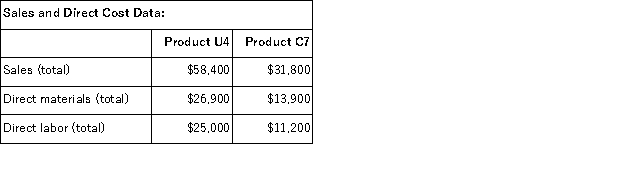

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Output Effect

When the price of any resource rises, the cost of production rises, which, in turn, lowers the supply of the final product. When supply falls, price rises, consequently reducing output.

Marginal Revenue Product

The additional revenue generated from employing one more unit of a factor of production, holding all other factors constant.

Additional Revenue

Income gained from any additional unit of output or sale beyond the current level of production or service.

Rent

A payment made by tenants to landlords in exchange for the use of real estate, equipment, or other properties.

Q6: The Lee Corporation uses a job-order costing

Q22: Waltz Corporation has two divisions: Xi and

Q31: Rauth Inc.uses a job-order costing in which

Q38: Activity rates in activity-based costing are computed

Q63: A cement manufacturer has supplied the following

Q69: Dideda Corporation uses an activity-based costing system

Q80: If the internal rate of return exceeds

Q88: If a company operates at the break

Q167: (Ignore income taxes in this problem. )Shiffler

Q214: Bateman Corporation, which has only one product,