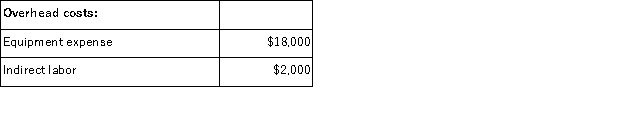

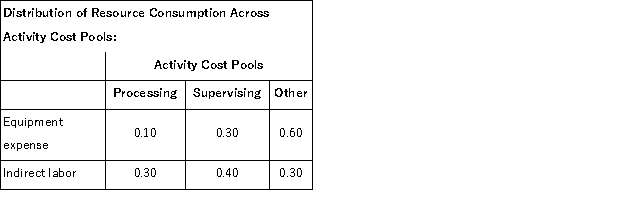

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

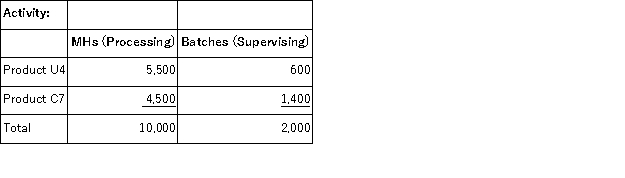

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

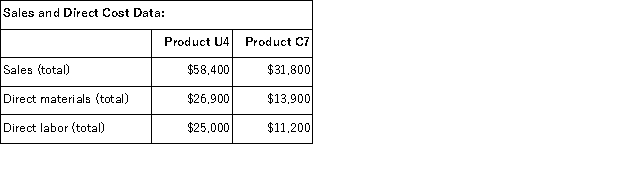

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  What is the product margin for Product U4 under activity-based costing?

What is the product margin for Product U4 under activity-based costing?

Definitions:

Tax Rate

The tax rate is the percentage at which an individual or corporation is taxed by the government, applicable to income, property, sales, etc.

Cost of Capital

The minimum earnings a firm should achieve on its investment initiatives to preserve its market worth and meet investor expectations.

Retail Outlets

Physical stores operated by retailers to sell merchandise directly to consumers.

Construction Supplies

Materials and goods used in the building and construction industry.

Q8: An avoidable cost is a cost that

Q22: In preference decision situations, a project with

Q33: (Ignore income taxes in this problem. )The

Q65: Walkenhorst Corporation has two divisions: Bulb Division

Q94: Duarte Corporation processes sugar beets that it

Q95: (Ignore income taxes in this problem. )A

Q119: A manufacturer of cedar shingles has supplied

Q131: When sales are constant, but the number

Q160: The unit sales volume necessary to reach

Q224: Bode Corporation has two divisions: East and