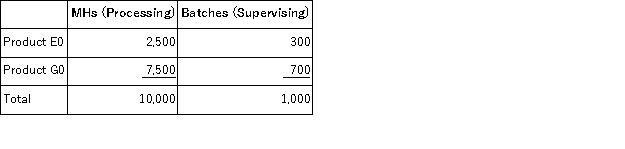

Trainor Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $29, 200;Supervising, $13, 000;and Other, $26, 800.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  What is the overhead cost assigned to Product G0 under activity-based costing?

What is the overhead cost assigned to Product G0 under activity-based costing?

Definitions:

News Monitoring

The practice of tracking media content to evaluate how news is covered and managed across various platforms.

Economic Espionage

The act of using covert techniques to gather confidential economic information about competitors or economic policies.

Marketing Plan

A road map for the marketing actions of an organization for a specified future time period, such as one year or five years.

Ethical Dilemma

A situation where a person must choose between conflicting principles or values, often involving a morally challenging decision.

Q8: An avoidable cost is a cost that

Q9: Grisham Corporation produces and sells a single

Q42: (Ignore income taxes in this problem. )Riveros,

Q53: Dybala Corporation produces and sells a single

Q88: Manton Corporation uses an activity based costing

Q90: Peterson Corporation produces a single product.Data from

Q96: Common fixed expenses should be allocated to

Q113: Rama Corporation is presently making part J56

Q120: Which of the following is NOT a

Q220: Schweinert Corporation manufactures a single product.The following