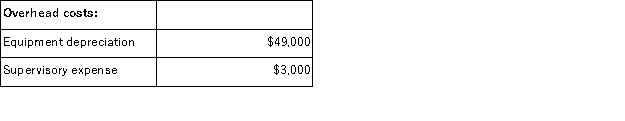

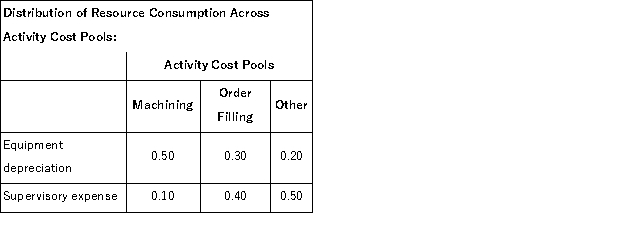

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

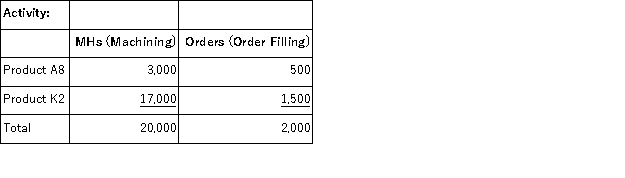

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Competitive Measurements

Metrics and benchmarks used to evaluate an organization's performance relative to its competitors.

Human Resource Productivity

The measure of how effectively the human resource department and the overall workforce generate output or achieve goals relative to input.

Labour Expenses

Costs associated with compensating employees, including wages, salaries, benefits, and taxes.

Rightsizing

Adjusting the number of employees to fit the current needs of the organization, which may involve layoffs or hiring.

Q6: Benoist Corporation has an activity-based costing system

Q17: (Ignore income taxes in this problem. )The

Q44: If a company decreases the variable expense

Q47: The management of Kabanuck Corporation is considering

Q48: Errera Corporation has two major business segments-Retail

Q54: A sales budget is given below for

Q67: The unit product cost under variable costing

Q116: Dace Company manufactures two products, Product F

Q119: Dockwiller Inc.manufactures industrial components.One of its products,

Q191: A manufacturing company that produces a single