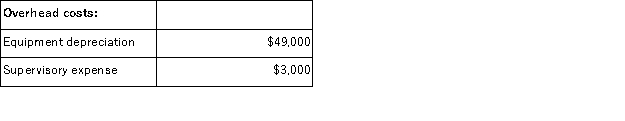

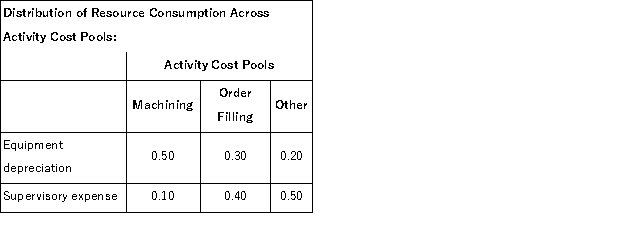

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

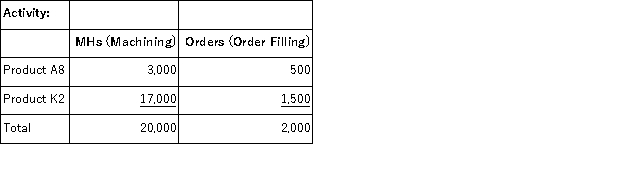

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  What is the overhead cost assigned to Product A8 under activity-based costing?

What is the overhead cost assigned to Product A8 under activity-based costing?

Definitions:

Stocks

Financial instruments that represent ownership in a company or corporation and represent a proportionate claim on its assets and earnings.

Valuation

The process of determining the present value of an asset or a company, based on its earnings, market position, and future potential.

Private Company

A business owned by private investors, shareholders, or owners, and not publicly traded on stock exchanges. It operates with less regulatory oversight than public companies.

Economic Agreements

Formal arrangements between parties, often nations or businesses, regarding the conduct of economic activity, including trade, investment, and regulation.

Q12: Moyle Corporation has provided the following data

Q29: Cowles Corporation, Inc.makes and sells a single

Q47: (Ignore income taxes in this problem. )Wombles

Q57: Phong Corporation has two divisions: Consumer Division

Q99: Keefe Corporation has two divisions: Western Division

Q129: Lusk Corporation produces and sells 20, 000

Q135: The costs assigned to units in inventory

Q165: A cost that can be avoided by

Q168: May Corporation, a merchandising firm, has budgeted

Q201: Sechrest Corporation manufactures a single product.Last year,