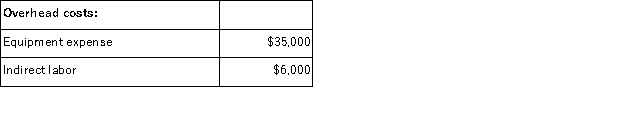

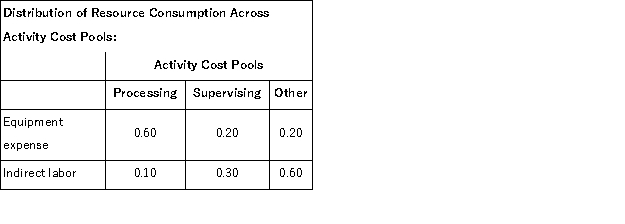

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

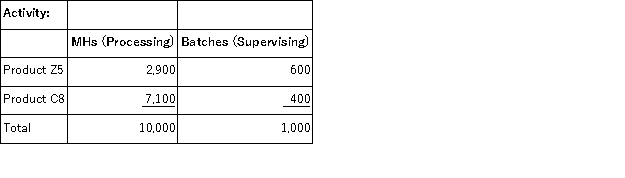

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Strategic Positioning

The process of determining how to distinguish an organization's offerings from competitors' to attract and maintain customers.

Meganational Strategy

A strategy used by corporations that operate on a global scale, focusing on maximizing their reach and resources across multiple national borders.

Adaptation

The process of change by which an individual or group becomes better suited to its environment or circumstances, often involving modifications in structure, behavior, or practices.

International Strategy

A business approach that entails deciding how to enter and operate in global markets, including considerations of scale, scope, and the adaptation of products and services for local needs.

Q19: Joint products are products that are sold

Q28: The following are the Jensen Corporation's unit

Q33: The split-off point in a process that

Q39: Dowchow Corporation makes two products from a

Q68: Studler Corporation has an activity-based costing system

Q85: Activity rates from Mcelderry Corporation's activity-based costing

Q89: If a company uses predetermined overhead rates,

Q128: Gabbert Corporation, which has only one product,

Q131: When sales are constant, but the number

Q157: (Ignore income taxes in this problem. )Crowley