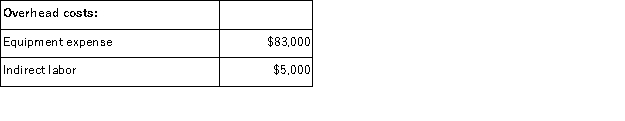

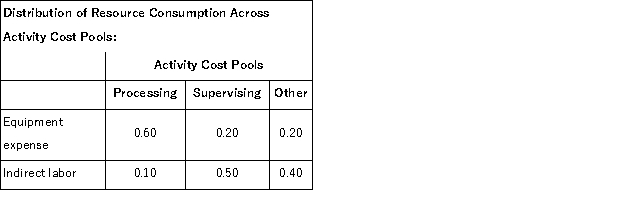

Studler Corporation has an activity-based costing system with three activity cost pools-Processing, Supervising, and Other.In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

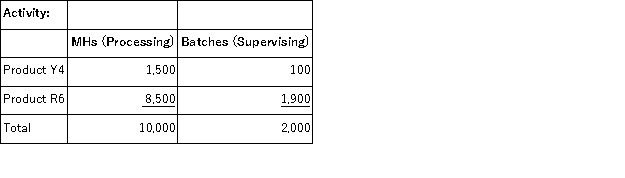

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Budget Constraint

The limits imposed on household choices by income, wealth, and product prices.

Apples

A widely consumed fruit, known for its crispiness and variety of flavors, often used as a symbol for health and education.

Utility Function

A mathematical representation of how different combinations of goods or services generate levels of happiness or satisfaction for a consumer.

Income

The money received by an individual or entity, typically on a regular basis, for work or through investments.

Q3: One assumption in CVP analysis is that

Q6: If a cost is a common cost

Q64: When production exceeds sales and the company

Q106: Aaker Corporation, which has only one product,

Q109: The term joint cost is used to

Q136: The margin of safety is:<br>A)the excess of

Q139: The LFG Corporation makes and sells a

Q167: Palinkas Cane Products Inc. , processes sugar

Q168: Under variable costing, variable production costs are

Q210: Brummitt Corporation has two divisions: the BAJ