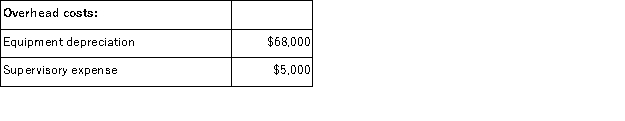

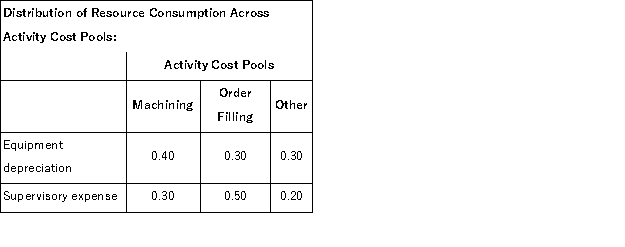

Keske Corporation has an activity-based costing system with three activity cost pools-Machining, Order Filling, and Other.In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to the three activity cost pools based on resource consumption.Data used in the first stage allocations follow:

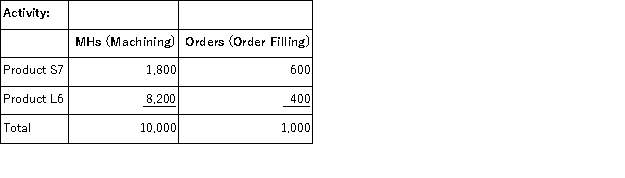

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

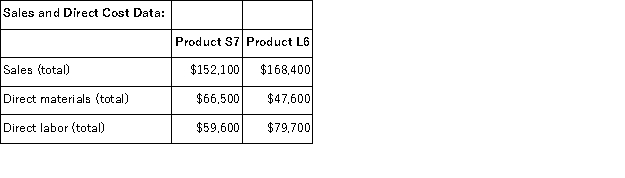

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.

Finally, the costs of Machining and Order Filling are combined with the following sales and direct cost data to determine product margins.  What is the overhead cost assigned to Product L6 under activity-based costing?

What is the overhead cost assigned to Product L6 under activity-based costing?

Definitions:

Dividends Received

Income received from shares in a company, typically distributed from profits to shareholders as decided by the board of directors.

Short-Term Investment

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business's operating cycle.

Readily Marketable

Assets that can be sold quickly and with minimal impact on their price due to their appeal to a wide range of buyers.

Operating Cycle

The average time that it takes to purchase inventory, sell it on account, and then collect cash from customers.

Q16: Loader Corporation has an activity-based costing system

Q44: The book value of old equipment is

Q92: Wenig Inc.has some material that originally cost

Q106: The Prattle Corporation makes and sells only

Q134: A study has been conducted to determine

Q137: The Madison Corporation produces three products with

Q158: Part S00 is used in one of

Q161: A manufacturing company that produces a single

Q166: Carrejo Corporation has two divisions: Division M

Q199: Pevy Corporation has two divisions: Southern Division