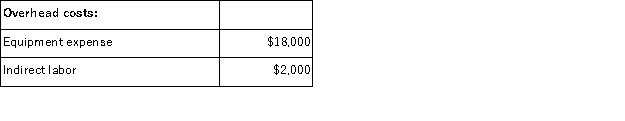

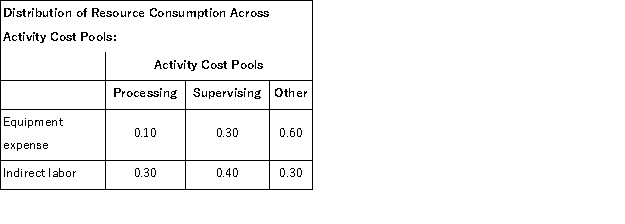

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

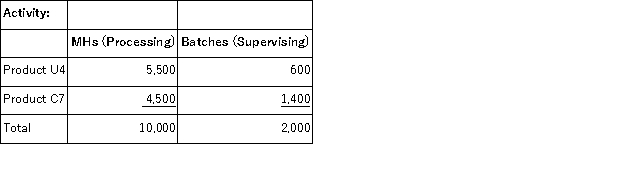

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

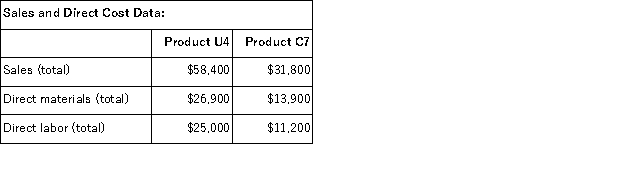

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Critical Values

Thresholds in statistical testing that delineate areas where the test statistic leads to the rejection or acceptance of the null hypothesis.

Variables

Elements, characteristics, or conditions that can change or vary within a study, potentially influencing the outcome.

Negative Number

A number less than zero, indicating a lack or subtraction in mathematics.

Pearson Correlation

A statistical measure that calculates the strength and direction of the linear relationship between two quantitative variables.

Q4: The selling and administrative expense budget of

Q5: Kapanga Manufacturing Corporation uses a job-order costing

Q15: Ofarrell Corporation, a company that produces and

Q34: (Ignore income taxes in this problem. )Allen

Q73: (Ignore income taxes in this problem. )Mercer

Q74: Arenz Corporation processes sugar cane in batches.The

Q80: Two of the reasons why manufacturing overhead

Q122: Keske Corporation has an activity-based costing system

Q143: The plant manager's salary is an example

Q144: The Molis Corporation has the capacity to