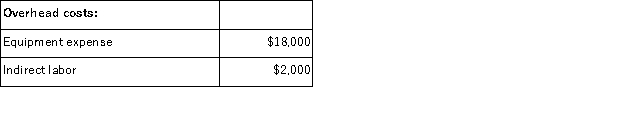

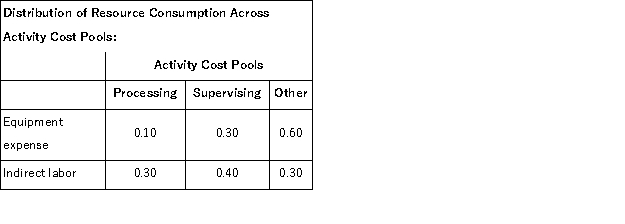

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

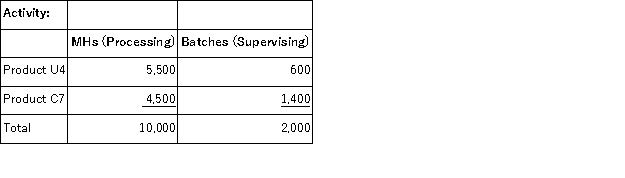

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

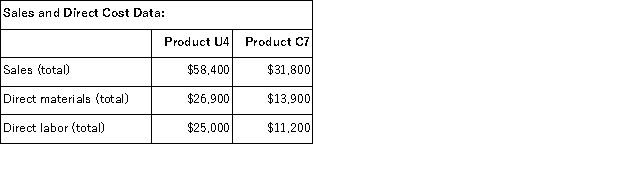

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  What is the overhead cost assigned to Product U4 under activity-based costing?

What is the overhead cost assigned to Product U4 under activity-based costing?

Definitions:

Premises

Statements or assertions in an argument that serve as the foundation or reasoning towards the conclusion.

Minus Sign

A mathematical symbol (-) indicating subtraction or the negative value of a number.

Diagram

A diagram is a simplified drawing or visual representation of a concept, object, process, or system, designed to explain how it works or to elucidate relationships between parts.

Arrows

In logic and mathematics, symbols used to represent logical relations, functions, or the direction of processes.

Q35: Gunderman Corporation has two divisions: the Alpha

Q51: Narciso Corporation is preparing a bid for

Q57: Job 231 was recently completed.The following data

Q62: Kosakowski Corporation processes sugar beets in batches.A

Q69: (Ignore income taxes in this problem. )Buy-Rite

Q118: Kosco Corporation produces a single product.The company's

Q119: A manufacturer of cedar shingles has supplied

Q131: Lake Corporation has an activity-based costing system

Q137: Sammis Inc, which produces and sells a

Q159: Cartier Inc.bases its manufacturing overhead budget on