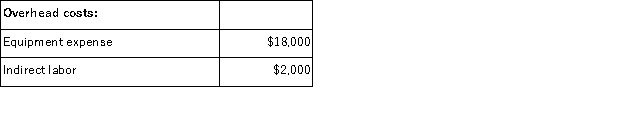

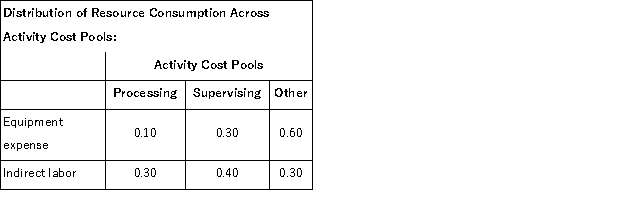

Kenrick Corporation uses activity-based costing to compute product margins.In the first stage, the activity-based costing system allocates two overhead accounts-equipment expense and indirect labor-to three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

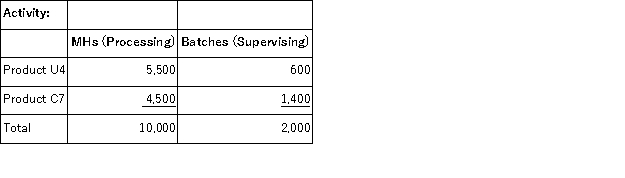

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

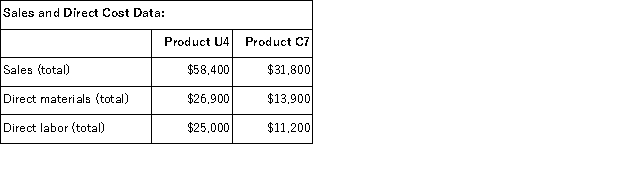

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.  What is the product margin for Product U4 under activity-based costing?

What is the product margin for Product U4 under activity-based costing?

Definitions:

Marginal Revenue

The increase in earnings a business gets by selling one extra unit of its goods or services.

Marginal Cost

The cost added by producing one additional unit of a product or service, a crucial concept for decision-making in business and economics.

Variable Costs

Costs that vary directly with the level of production or output, such as raw materials and labour costs.

Variable Costs

Costs that change in proportion to the level of output or business activity, such as materials and labor directly involved in production.

Q11: (Ignore income taxes in this problem. )Ataxia

Q25: If two companies produce the same product

Q29: Pirkl Corporation has provided the following data

Q40: Which of the following will have the

Q45: In activity-based costing, nonmanufacturing costs are not

Q63: Which of the following would probably be

Q98: Cervetti Corporation has two major business segments-East

Q110: Bowe Corporation's fixed monthly expenses are $21,

Q111: In general, duration drivers are more accurate

Q170: A cement manufacturer has supplied the following