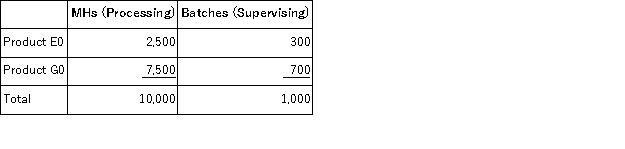

Trainor Corporation uses activity-based costing to assign overhead costs to products.Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $29, 200;Supervising, $13, 000;and Other, $26, 800.Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  What is the overhead cost assigned to Product G0 under activity-based costing?

What is the overhead cost assigned to Product G0 under activity-based costing?

Definitions:

Tonometry

A diagnostic test used to measure the pressure inside the eye, which is important for diagnosing and managing glaucoma.

Mydriatic

Pertaining to or causing dilation of the pupils; often used in eye examinations or surgeries.

Miotic

Pertaining to substances or medications that cause the pupil of the eye to constrict.

Cholinergic

Pertaining to cells or substances that release or are activated by acetylcholine, a neurotransmitter.

Q20: Baab Corporation is a manufacturing firm that

Q20: Mussenden Corporation has an activity-based costing system

Q32: Broberg Inc.uses a job-order costing system in

Q41: The following data have been provided by

Q54: (Ignore income taxes in this problem. )Pro-Mate,

Q64: (Ignore income taxes in this problem. )Lajeunesse

Q77: Criblez Corporation has two divisions: Blue Division

Q106: When cash flows are uneven and vary

Q138: Under absorption costing, the profit for a

Q179: Sosinski Corporation has two divisions: Domestic Division