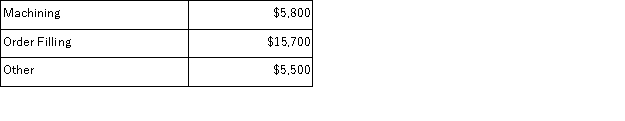

Munar Corporation uses activity-based costing to compute product margins.Overhead costs have already been allocated to the company's three activity cost pools-Machining, Order Filling, and Other.The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:

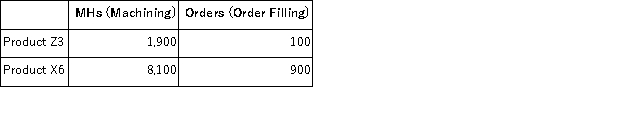

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data appear below:  Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

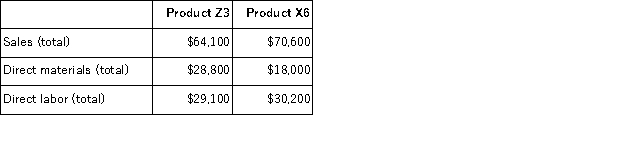

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.  What is the product margin for Product X6 under activity-based costing?

What is the product margin for Product X6 under activity-based costing?

Definitions:

Return On Equity

A measure of a corporation's profitability, indicating how much profit is generated with the money shareholders have invested.

Return On Assets Ratio

A financial metric used to evaluate a company's efficiency in generating profits from its assets, calculated by dividing net income by total assets.

Debt And Equity Financing

Ways in which a company raises funds through borrowing (debt) or selling ownership shares (equity).

ROE

Return on Equity, a measure of financial performance calculated by dividing net income by shareholder's equity.

Q2: Crystal Corporation produces a single product.The company's

Q13: Carlton Corporation sells a single product at

Q29: The following data pertain to last year's

Q67: Alpha Corporation reported the following data for

Q71: Rogers Corporation is preparing its cash budget

Q81: Gierlach Beet Processors Inc. , processes sugar

Q106: The Prattle Corporation makes and sells only

Q142: A project requires an initial investment of

Q152: (Ignore income taxes in this problem. )Westland

Q168: Fixed costs may or may not be