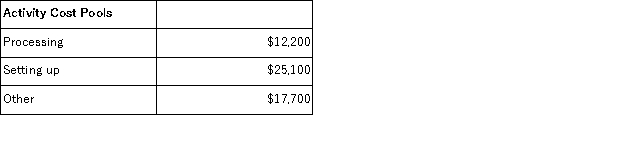

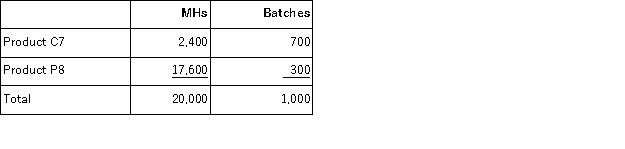

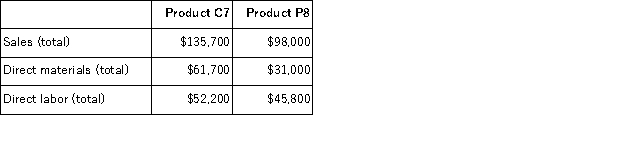

Wasden Corporation has an activity-based costing system with three activity cost pools-Processing, Setting Up, and Other.Costs in the Processing cost pool are assigned to products based on machine-hours (MHs)and costs in the Setting Up cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs and activity-based costing system appear below:

Required:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.

b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.

c.Determine the product margins for each product using activity-based costing.

Definitions:

Task-achievement Scaling

A method used to measure the success in completing specific tasks or achieving goals, often used in project management and educational settings.

Validity

The degree to which a test, tool, or study accurately measures what it is intended to measure or accurately reflects the concept it is intended to capture.

Reliability

The degree to which an assessment tool produces stable and consistent results over time.

Termination

In various contexts, it can mean the end of an agreement, employment, process, or a project.

Q63: The cost of goods sold in a

Q74: Schrum Inc. , which uses job-order costing,

Q102: Futter Corporation uses an activity-based costing system

Q117: Activity-based costing involves a two-stage allocation in

Q117: The Fraley Corporation, a merchandising firm, has

Q127: (Ignore income taxes in this problem. )The

Q130: Rede Inc.manufactures a single product.Variable costing net

Q137: The Madison Corporation produces three products with

Q175: A company produces a single product.Variable production

Q209: Hardee Inc. , which produces a single