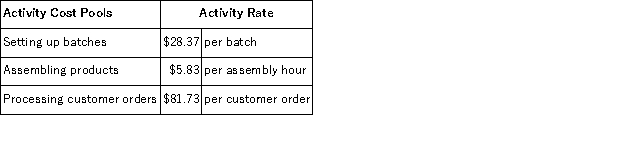

Garhart Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products.  Data concerning two products appear below:

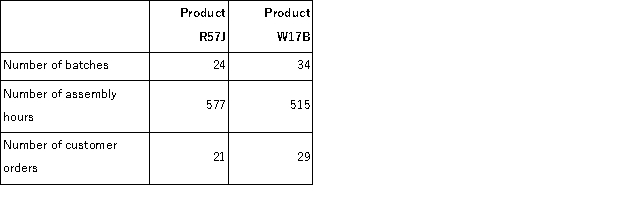

Data concerning two products appear below:  Required:

Required:

a.How much overhead cost would be assigned to Product R57J using the company's activity-based costing system? Show your work!

b.How much overhead cost would be assigned to Product W17B using the company's activity-based costing system? Show your work!

Definitions:

Payroll Accounting

The process of recording and managing all financial transactions related to a company's payment of salaries, wages, and other compensations to employees.

Employee Morale

The general perspective, mood, contentment, and self-assurance that staff experience in the workplace.

Cash Flow Problems

Financial difficulties faced by a business due to inadequate cash to cover its obligations.

Federal Income Taxes

Charges imposed by the United States federal government on the yearly income of people, businesses, trusts, and various legal bodies.

Q8: (Ignore income taxes in this problem. )Janes,

Q13: The labor time ticket contains a detailed

Q17: (Ignore income taxes in this problem. )The

Q38: A manufacturer of tiling grout has supplied

Q47: Schulenburg Corporation has provided the following data

Q57: (Ignore income taxes in this problem. )Lajeunesse

Q81: The cost categories that appear on a

Q90: Peterson Corporation produces a single product.Data from

Q133: Assembling a product is an example of

Q135: Farnsworth Television makes and sells portable television