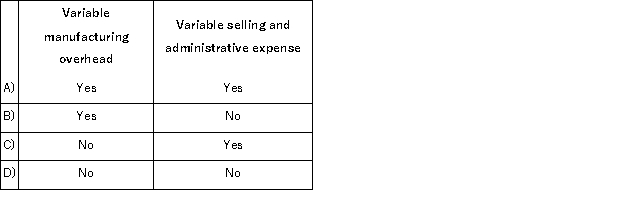

Which of the following costs at a manufacturing company would be treated as a product cost under both absorption costing and variable costing?

Definitions:

Red Income

This term is also not recognized in standard economic discussions and might be used in a specific context that is not universally defined.

Ambrosia

Often referred to in ancient texts, ambrosia is described as a divinely nourishing substance associated with immortality.

Blue Income

Similar to "Red Income," this term does not have a recognized definition in economics and likely pertains to a specific, non-standard use.

Ambrosia

In mythology, it is the food or drink of the gods, thought to confer immortality, but in a general context, it refers to something very pleasing to taste or smell.

Q1: Cacioppo Corporation bases its predetermined overhead rate

Q15: If taxes are ignored, all of the

Q28: When the number of units in work

Q58: Yehle Inc.regularly uses material Y51B and currently

Q62: Organization-sustaining overhead costs should be allocated to

Q89: Buentello Corporation produces and sells a single

Q92: Monson Corporation has two products: G and

Q110: Depreciation expense on existing factory equipment is

Q158: Reynold Enterprises sells a single product for

Q169: Hossack Corporation produces a single product and