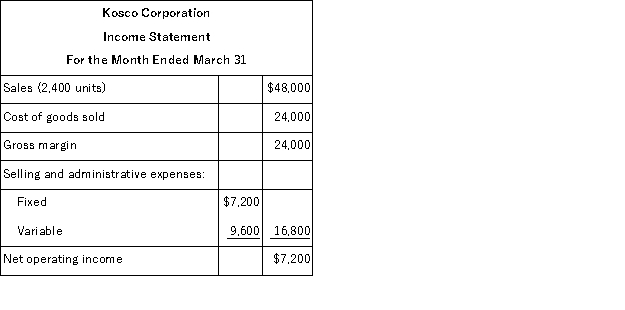

Kosco Corporation produces a single product.The company's absorption costing income statement for March follows:  During March, the company's variable production costs were $8 per unit and its fixed manufacturing overhead totaled $5, 000. Net operating income under variable costing for March would be:

During March, the company's variable production costs were $8 per unit and its fixed manufacturing overhead totaled $5, 000. Net operating income under variable costing for March would be:

Definitions:

Equipment Purchase

Equipment purchase refers to the acquisition of physical assets, such as machinery or tools, necessary for a company to operate and produce goods or provide services.

Operating Activities

Transactions and events that relate to the core business functions, such as receipts from sales of goods and services, payments to suppliers, and salaries to employees.

Depreciable Asset

A type of asset that loses value over time due to wear and tear, decay, or obsolescence, which can be accounted for through depreciation.

Indirect Method

A method of preparing the cash flow statement in which net income is adjusted for non-cash transactions and changes in working capital.

Q26: In a job-order costing system, the amount

Q59: Lopp Corporation produces and sells a single

Q66: An activity-based costing system that is designed

Q83: Ramon Corporation makes 18, 000 units of

Q109: Carsten Wedding Fantasy Corporation makes very elaborate

Q119: (Ignore income taxes in this problem. )Hinck

Q154: The Flint Fan Corporation is considering the

Q173: Hermenegildo Corporation is presently making part P42

Q174: The Agate Corporation manufactures and sells two

Q185: O'Neill, Incorporated's segmented income statement for the