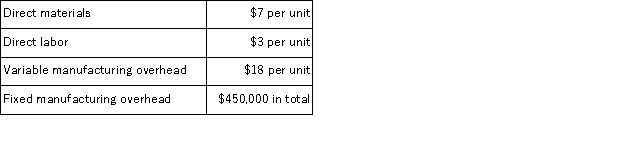

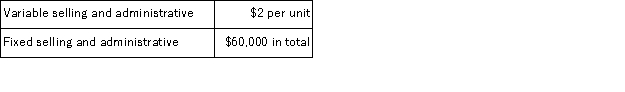

During its first year of operations, Carlos Manufacturing Corporation incurred the following costs to produce 8, 000 units of its only product:  The company also incurred the following costs in selling 7, 500 units of product during its first year:

The company also incurred the following costs in selling 7, 500 units of product during its first year:  Assume that direct labor is a variable cost. Under variable costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Assume that direct labor is a variable cost. Under variable costing, what is the total cost that would be assigned to Carlos' finished goods inventory at the end of the first year of operations?

Definitions:

Direct Materials Cost

The cost of raw materials that can be directly attributed to the production of goods.

Activity-Based Costing

A costing methodology that assigns overhead and indirect costs to specific products or projects based on their consumption of resources.

Direct Labor-Hours

The total hours worked directly on manufacturing a product or providing a service.

Direct Materials Cost

The cost of raw materials that can be directly attributed to the production of specific goods or services.

Q10: Boenisch Corporation produces and sells a single

Q15: Keefe Corporation has two divisions: Western Division

Q40: Crane Corporation makes four products in a

Q69: Crossbow Corp.produces a single product.Data concerning June's

Q73: Zumbrunnen Corporation uses activity-based costing to compute

Q76: Stroth Corporation uses activity-based costing to compute

Q78: The first-stage allocation in activity-based costing is

Q89: If a company uses predetermined overhead rates,

Q96: (Ignore income taxes in this problem. )Vernon

Q107: Chown Corporation, which has only one product,