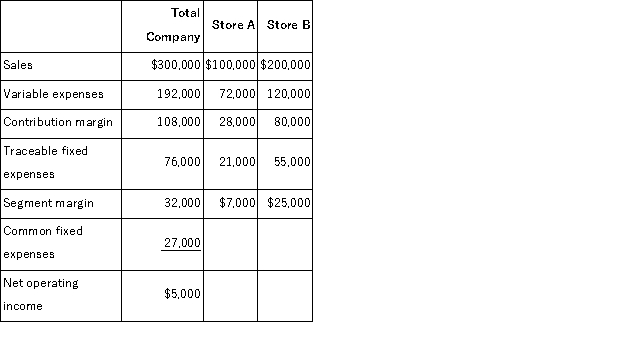

O'Neill, Incorporated's segmented income statement for the most recent month is given below.  For each of the following questions, refer back to the above original data. If Store B sales increase by $20, 000 with no change in fixed expenses, the overall company net operating income should:

For each of the following questions, refer back to the above original data. If Store B sales increase by $20, 000 with no change in fixed expenses, the overall company net operating income should:

Definitions:

Tax-exempt Income

Income that is not subject to federal income tax, such as certain interest income from municipal bonds.

Ordinary Income

Income earned from standard operations, subject to standard tax rates, including wages, salaries, commissions, and interest.

Distributed

In finance, refers to the allocation of dividends or other payouts to shareholders from a corporation's earnings.

Recognized

Acknowledged or understood, often referring to income, gains, or losses for tax purposes.

Q2: Fabio Corporation is considering eliminating a department

Q15: Keefe Corporation has two divisions: Western Division

Q28: A partial listing of costs incurred during

Q43: When using data from a segmented income

Q83: Liest Corporation produces and sells a single

Q91: The following production and average cost data

Q96: Common fixed expenses should be allocated to

Q117: Under absorption costing, it is possible to

Q126: Boenisch Corporation produces and sells a single

Q160: The unit sales volume necessary to reach