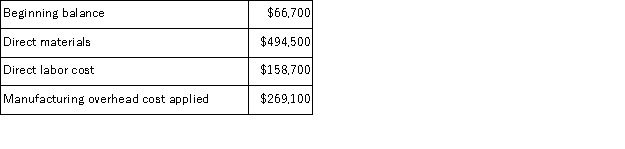

Toan Inc.uses a job-order costing system in which any underapplied or overapplied overhead is closed to cost of goods sold at the end of the month.In September the company completed job S80M that consisted of 23, 000 units of one of the company's standard products.No other jobs were in process during the month.The job cost sheet for job S80M shows the following costs:  During the month, the actual manufacturing overhead cost incurred was $270, 020 and 3, 000 completed units from job S80M were sold.No other products were sold during the month. The unit product cost for job S80M is closest to:

During the month, the actual manufacturing overhead cost incurred was $270, 020 and 3, 000 completed units from job S80M were sold.No other products were sold during the month. The unit product cost for job S80M is closest to:

Definitions:

Dividend Reinvestment

The process of using dividend payouts from shares to purchase additional shares in the same company, compounding the investment's growth.

Dividend Policy

A set of guidelines a company follows to decide how much of its earnings it will pay out to shareholders in dividends.

Dividend

A portion of a company's earnings that is paid to shareholders, typically on a quarterly basis.

Dividend Level

The amount of dividend payment declared by a company per share, usually expressed in a currency value.

Q19: Hatfield Corporation, which has only one product,

Q20: If the level of activity increases within

Q22: Cardillo Inc. , an escrow agent, has

Q49: Searls Corporation, a merchandising company, reported the

Q54: All other things the same, a reduction

Q59: Lopp Corporation produces and sells a single

Q76: Mat Corporation's actual manufacturing overhead cost for

Q106: Keske Corporation has an activity-based costing system

Q121: Pen Corporation manufactures a single product.Last year,

Q185: O'Neill, Incorporated's segmented income statement for the