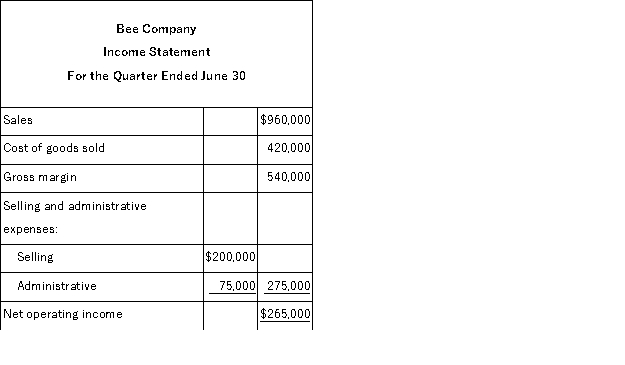

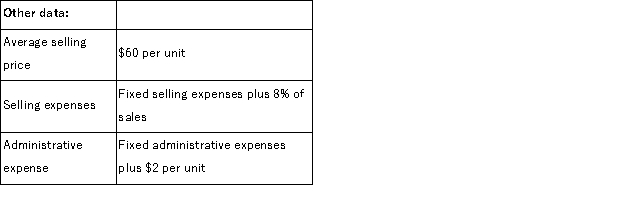

Bee Company is a honey wholesaler.An income statement and other data for the second quarter of the year are given below:

Bee Company's cost formula for total selling and administrative expenses, with "X" equal to the number of units sold would be:

Bee Company's cost formula for total selling and administrative expenses, with "X" equal to the number of units sold would be:

Definitions:

Business Ownership

Business Ownership entails the possession, control, and responsibility over a business entity, including rights to its assets and liabilities.

Corporation

A legal entity that is separate and distinct from its owners, offering Limited liability to its shareholders, and having the ability to raise capital through issuing stock.

Non-profit

A non-profit organization is one that operates for a collective, public or social benefit, rather than to make money for its owners or investors.

Sole Proprietorship

A type of business structure owned and run by one individual where there is no legal distinction between the owner and the business.

Q1: (Appendix 11A)Pizzi, Inc.had the following fixed manufacturing

Q14: Abare Corporation reported the following data for

Q36: An example of a discretionary fixed cost

Q62: Crombie Inc.uses a job-order costing system in

Q68: The management of Claypole Corporation has provided

Q75: Simmons Corporation estimated that the following costs

Q85: (Appendix 11A)A furniture manufacturer uses a standard

Q133: At a sales volume of 37, 000

Q185: Committed fixed costs represent organizational investments with

Q199: Pevy Corporation has two divisions: Southern Division