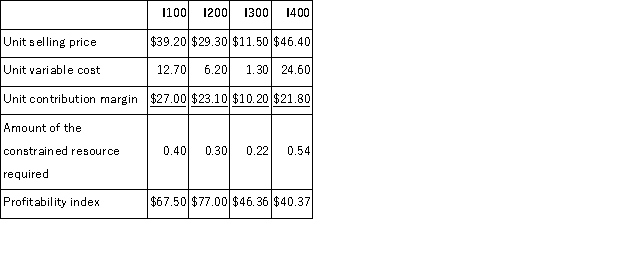

Jacobus Corporation has four products that use the same constrained resource.Data concerning those products appear below:  The company does not have enough of the constrained resource to satisfy for demand of all four products. From the standpoint of the entire company, if it is a choice between sales of one unit of one product versus another, which product should the salespersons emphasize?

The company does not have enough of the constrained resource to satisfy for demand of all four products. From the standpoint of the entire company, if it is a choice between sales of one unit of one product versus another, which product should the salespersons emphasize?

Definitions:

Deferred Tax Liabilities

Obligations for taxes owed in the future due to temporary differences between the tax basis of an asset or liability and its reported amount in the financial statements.

Book Income Tax Expense

The amount of income tax a company reports in its financial statements, which may differ from the tax owed to tax authorities.

Deferred Tax Asset

An accounting term for items that reduce future tax liability because of temporary differences between the book value and the tax value of assets and liabilities.

Future Taxable Income

The income that a company or individual expects to earn in future periods that will be subject to tax.

Q9: (Appendix 8A)(Ignore income taxes in this problem.

Q23: (Appendix 12B)If a portion of the actual

Q29: Relative profitability should be measured by dividing

Q29: (Appendix 8C)Lastufka Corporation is considering a capital

Q32: Samples Corporation would like to use target

Q43: Luter Products Inc.makes two products-G16F and C53Z.Product

Q58: Dechico Corporation purchased a machine 3 years

Q72: Tansley Corporation has two products that use

Q94: Farber Corporation uses a job-order costing system.The

Q156: Corcetti Company manufactures and sells prewashed denim