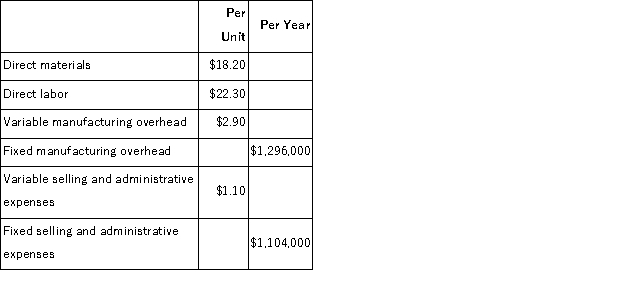

Dickson Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

Direct labor is a variable cost in this company.

If every 10% increase in price leads to a 14% decrease in quantity sold, the profit-maximizing price is closest to:

Definitions:

Cerumen Impaction

A blockage of the ear canal with earwax (cerumen), which can cause pain and hearing loss.

Immobilization

The act of restricting movement to prevent further injury or to assist in the healing process of bones, joints, or muscles.

Stapes

A small, stirrup-shaped bone in the middle ear that plays a key role in transmitting sound vibrations to the inner ear.

Bony Labyrinth

A complex system of channels and cavities within the temporal bone of the skull, housing the organs of hearing and balance.

Q4: Lacy Corporation uses the absorption costing approach

Q16: Krupka Corporation's two products have the following

Q27: (Appendix 12B)For performance evaluation purposes, any variance

Q38: Alley Corporation's vice president in charge of

Q43: Luter Products Inc.makes two products-G16F and C53Z.Product

Q52: Havely International Corporation's only product sells for

Q58: (Appendix 8C)Kostka Corporation is considering a capital

Q104: (Appendix 11A)Dexter Corporation uses a standard cost

Q117: The following production and average cost data

Q126: Inspection costs at one of Iuliano Corporation's