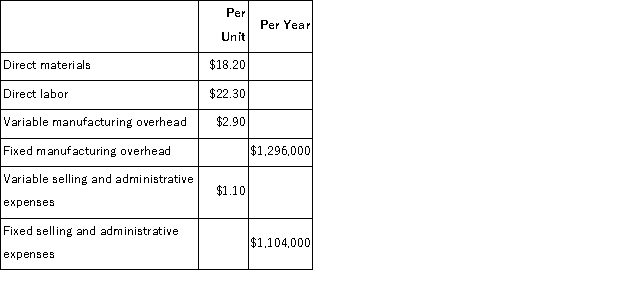

Dickson Corporation makes a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

The company uses the absorption costing approach to cost-plus pricing described in the text.The pricing calculations are based on budgeted production and sales of 60, 000 units per year. The company has invested $320, 000 in this product and expects a return on investment of 15%.

Direct labor is a variable cost in this company.

The selling price based on the absorption costing approach is closest to:

Definitions:

Net Present Value

It involves gauging the current value disparity between cash receipts and disbursements over a set time frame.

Shareholder Wealth

Shareholder wealth is the total value of an investment in a company, often measured by the market value of the shareholder's equity, which includes stock price appreciation and dividends.

Payback Period

The length of time required to recover the initial cost of an investment, highlighting the investment's risk and liquidity.

Modified Internal Rate

A version of the Internal Rate of Return (IRR) calculation that adjusts for changes in cash flows over the project's life, offering a more nuanced evaluation of profitability.

Q7: (Appendix 12A)The Red River Division of Alto

Q22: (Appendix 12B)The medical services department of Bantam

Q22: Garcia Veterinary Clinic expects the following operating

Q26: (Appendix 4B)The management of Benedict Corporation would

Q39: Marano Corporation produces and sells a single

Q48: Brown Corporation has sales of 2, 000

Q62: (Appendix 11A)Vette Tie Corporation has developed the

Q138: (Appendix 8C)Stack Corporation is considering a capital

Q159: In the most recent month, Shoemaker Corporation's

Q166: Maintenance costs at a Whetsel Corporation factory