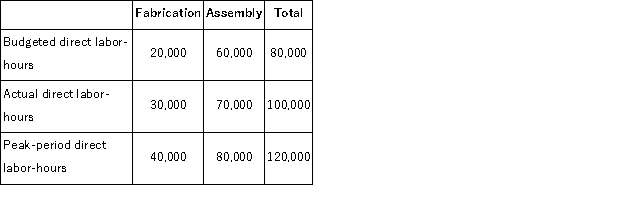

(Appendix 12B) Nathan Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments.Costs of the equipment Services Department are charged to the Fabrication and Assembly Departments on the basis of direct labor-hours.Data on direct labor-hours for last year follow:  For the year just ended, the company budgeted its variable maintenance costs at $200, 000 for the year.Actual variable maintenance costs for the year totaled $275, 000. How much (if any) of the $275, 000 in variable maintenance cost should not be charged to the Fabrication and Assembly Departments?

For the year just ended, the company budgeted its variable maintenance costs at $200, 000 for the year.Actual variable maintenance costs for the year totaled $275, 000. How much (if any) of the $275, 000 in variable maintenance cost should not be charged to the Fabrication and Assembly Departments?

Definitions:

Absorption Costing

An accounting method that includes all manufacturing costs — direct materials, direct labor, and both variable and fixed manufacturing overhead — in the cost of a product.

Operating Income

A measure of a company's profit that excludes non-operating expenses and revenues, focusing solely on the income generated from its core business operations.

Inventory Levels

The quantity of goods and materials on hand at a particular time within a company.

Variable Costing Income Statement

A financial statement showing the costs that vary directly with the level of production, separated from fixed costs.

Q4: (Appendix 12B)Service department costs should not be

Q10: (Appendix 6A)Hasty Hardwood Floors installs oak and

Q34: Under the absorption approach to costs-plus pricing

Q43: Bluhm Corporation's management believes that every 2%

Q49: (Appendix 11A)The Claus Corporation makes and sells

Q52: (Appendix 11A)Hairr Corporation bases its predetermined overhead

Q57: Merced Corporation estimates that an investment of

Q87: Gonyo Inc. , which produces and sells

Q92: Electrical costs at one of Reifel Corporation's

Q138: Upchurch Corporation produces and sells a single