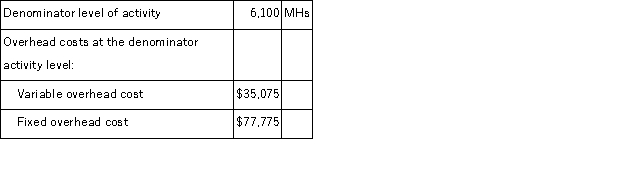

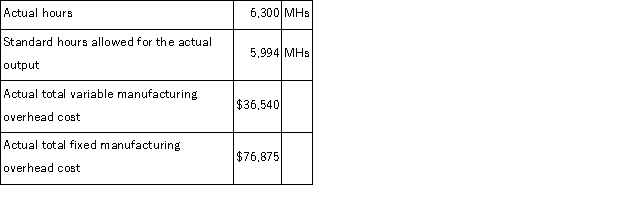

(Appendix 11A) A manufacturing company uses a standard costing system in which standard machine-hours (MHs) is the measure of activity.Data from the company's flexible budget for manufacturing overhead are given below:  The following data pertain to operations for the most recent period:

The following data pertain to operations for the most recent period:  The predetermined overhead rate per MH is closest to:

The predetermined overhead rate per MH is closest to:

Definitions:

Net Rental Income

The income received from rental properties after deducting expenses such as mortgage interest, property taxes, maintenance, and management fees.

Security Deposit

Money paid upfront as security against damage or non-payment, commonly associated with rental agreements, to be returned or applied as per agreement terms.

Rental Income

Income received from renting out a property, such as a house or an apartment.

AGI

Adjusted Gross Income (AGI) is a measure of income calculated from your gross income and used to determine how much of your income is taxable.

Q6: (Appendix 5A)All differences between super-variable costing and

Q12: The management of Liess Corporation has provided

Q21: (Appendix 4B)The management of Cordona Corporation would

Q22: The management of Claypole Corporation has provided

Q23: (Appendix 12A)In setting a transfer price, which

Q33: (Appendix 11A)A company has a standard cost

Q44: (Appendix 12B)Vancuren Corporation has two operating divisions-an

Q54: The management of Archut Corporation would like

Q76: Management of Daubert Corporation is considering a

Q163: Abbott Company's manufacturing overhead is 20% of