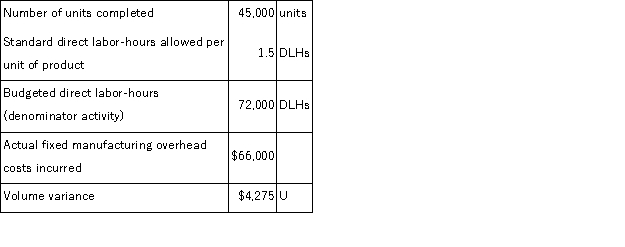

(Appendix 11A) The Murray Corporation makes and sells a single product.The company recorded the following activity and cost data for May:  The fixed component of the predetermined overhead rate is $0.95 per direct labor-hour. The fixed manufacturing overhead used to calculate the predetermined overhead rate was:

The fixed component of the predetermined overhead rate is $0.95 per direct labor-hour. The fixed manufacturing overhead used to calculate the predetermined overhead rate was:

Definitions:

International Trade

The exchange of goods, services, and capital across international borders, driven by the concept of comparative advantage.

Tariff

A tax imposed on imported goods and services to increase their price and reduce competition with domestic products.

Exported

Products or services that are transported from one nation to another for the purpose of being sold or traded.

Q7: (Appendix 8A)(Ignore income taxes in this problem.

Q8: (Appendix 11A)Coblentz Fabrication Corporation has a standard

Q11: Intonation refers to<br>A) the production of vowel-like

Q18: Davis Corporation has provided the following production

Q26: The Bayley Scales of Infant Development consist

Q46: All of the following would be classified

Q57: Which of the following is a CORRECT

Q83: Infants who are younger than six months

Q85: (Appendix 8C)Prudencio Corporation has provided the following

Q151: The planning horizon for a committed fixed