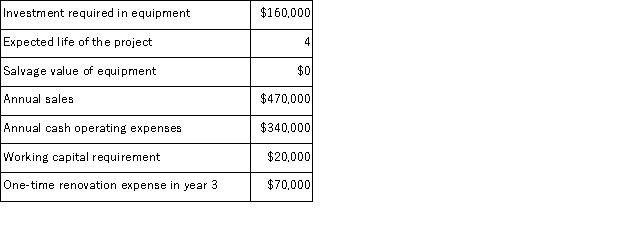

(Appendix 8C) Pont Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

Definitions:

Adaptability

The quality of being able to adjust to new conditions or environments, showing flexibility in coping with changes.

Quality of Life

The general well-being of individuals and societies, outlining the negative and positive aspects of life, including health, comfort, and happiness.

Sense of Taste

One of the five senses, culminating from the ability to perceive and distinguish flavors through the taste buds in the mouth.

Hypertension

A chronic medical condition in which the blood pressure in the arteries is persistently elevated.

Q2: The markup over cost under the absorption

Q3: Gillis Corporation's marketing manager believes that every

Q15: (Appendix 6A)If a cost object such as

Q26: A language's rules for combining words to

Q54: One way that young infants seem to

Q56: The markup over cost under the absorption

Q86: (Appendix 11A)Bruley Corporation applies manufacturing overhead to

Q93: (Appendix 8C)Blier Corporation has provided the following

Q110: (Appendix 8C)Beecroft Corporation is considering a capital

Q114: (Appendix 8C)Voelkel Corporation has provided the following