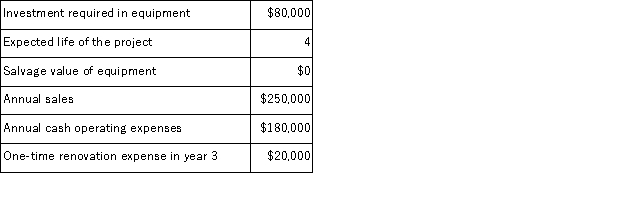

(Appendix 8C) Credit Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Civil Rights Groups

Organizations and collectives that advocate for the protection and expansion of individual rights and liberties, especially for marginalized and oppressed groups.

Great Society

A set of domestic programs in the United States launched by President Lyndon B. Johnson to eliminate poverty and racial injustice.

Medicaid

A government-sponsored insurance program in the United States providing health coverage to people with low income.

War On Poverty

A set of government programs introduced in the 1960s in the United States aimed at reducing poverty rates through education, health care, and social services.

Q4: (Appendix 8A)(Ignore income taxes in this problem.

Q5: Holding all other things constant, if the

Q19: (Appendix 12B)For performance evaluation purposes, the variable

Q22: (Appendix 5A)The super-variable costing net operating income

Q40: The management of Kull Corporation has provided

Q46: Modern definitions of giftedness differ from the

Q69: (Appendix 11A)Tillinghast Corporation estimates that its variable

Q77: (Appendix 11A)The fixed manufacturing overhead budget variance

Q93: The idea that a general factor for

Q111: At an activity level of 8, 800