(Appendix 8C)Shinabery Corporation Has Provided the Following Information Concerning a Capital

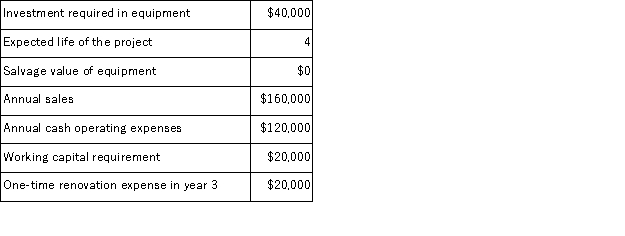

(Appendix 8C) Shinabery Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 9%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

The company's income tax rate is 35% and its after-tax discount rate is 9%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

Definitions:

Maturity Value

Maturity Value is the amount payable to an investor at the end of a fixed-term investment, including the principal and the interest earned.

Dollar Amount

A numerical value specifying an amount of money in terms of the dollar currency.

Phillips, Hager & North

A Canadian investment management firm, known for its mutual funds and portfolio management services.

Canadian Equity Fund

An investment fund that concentrates on equities (stocks) based in Canada.

Q16: Ritchie Corporation manufactures a product that has

Q26: (Appendix 12B)Budgeted fixed costs in Swasey company's

Q32: (Appendix 5A)Moffa Corporation manufactures and sells one

Q64: Jacobus Corporation has four products that use

Q65: Locken Products Inc.makes two products-Q96T and T62D.Product

Q72: (Appendix 8C)Brodigan Corporation has provided the following

Q72: Tansley Corporation has two products that use

Q72: (Appendix 11A)Nitrol Corporation manufactures brass vases using

Q73: Sawit Corporation, a manufacturer of woodworking tools,

Q92: The term semantics refers to<br>A) the sounds