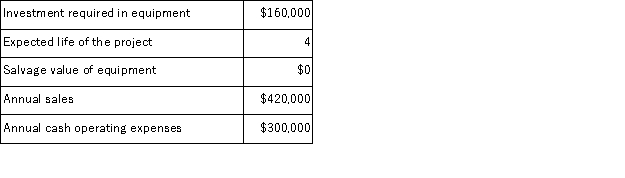

(Appendix 8C) Voelkel Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 7%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 7%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Stated Dollar Amount

A specified amount of money expressed in dollars, often referring to the face value of financial instruments or the nominal amount in transactions.

Credit Ratings

Assessments of the creditworthiness of borrowers, ranging from governments to private enterprises, indicating their ability to repay borrowed money.

Speculative

Involving financial transactions with a high risk of loss but also the potential for significant gains, often based on future expectations.

Coupon Interest Rate

The annual interest rate paid on a bond, expressed as a percentage of the face value.

Q3: (Appendix 12B)Charges for service department costs to

Q11: (Appendix 8C)Amel Corporation has provided the following

Q12: (Appendix 12A)The Red River Division of Alto

Q16: Ritchie Corporation manufactures a product that has

Q19: Hamelinck Corporation would like to determine the

Q52: (Appendix 8C)Welti Corporation has provided the following

Q71: (Appendix 11A)Pohl Corporation uses a standard cost

Q72: A cochlear implant is a device that

Q82: The Bayley Scales of Infant Development<br>A) are

Q104: (Appendix 8C)Skolfield Corporation is considering a capital