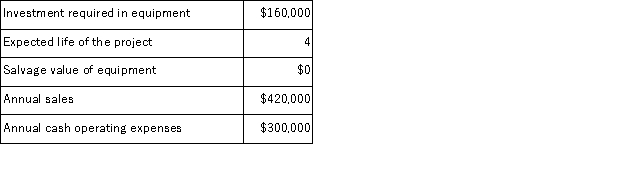

(Appendix 8C) Voelkel Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 7%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 7%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 2 is:

Definitions:

Selling Price

The amount of money a customer pays to buy a product or service, determined by various factors including cost, market demand, and competition.

Unit Product Costs

The combined expenses of direct materials, direct labor, and manufacturing overhead incurred in the production of a single product unit.

Job M598

A specific reference to an individual job or project within a job costing system, indicating a unique piece of work for tracking costs.

Overhead Applied

The process of assigning or allocating overhead costs to products or cost objects based on a predetermined overhead rate.

Q6: (Appendix 4A)Koszyk Manufacturing Corporation has a traditional

Q9: (Appendix 4B)The management of Richbourg Corporation would

Q12: (Appendix 8A)(Ignore income taxes in this problem.

Q20: Infants pay more attention to<br>A) a referential

Q23: (Appendix 12B)If a portion of the actual

Q49: (Appendix 5A)Mendoza Corporation manufactures and sells one

Q53: Roughly _% of North American children are

Q114: (Appendix 8C)Voelkel Corporation has provided the following

Q123: (Appendix 8C)Gloden Corporation has provided the following

Q180: Ence Sales, Inc. , a merchandising company,