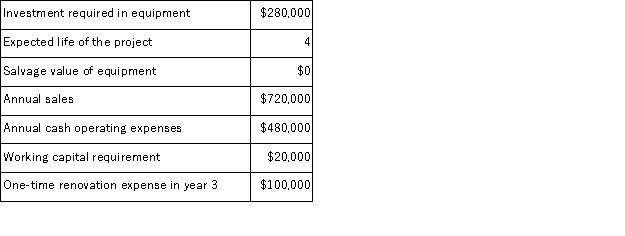

(Appendix 8C) Erling Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 15%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

The company's income tax rate is 35% and its after-tax discount rate is 15%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

Definitions:

Wage Disparity

The difference in wages earned by different groups of workers, often arising from factors such as occupation, education, experience, or gender.

Talent and Ability

The natural aptitude or acquired skills possessed by individuals that enable them to perform certain tasks or excel in certain fields.

Median Earnings

The middle value of income earned, such that half of earners make more and half make less, often used to measure central tendency of income distribution.

Compensating Differentials

Wage differentials that arise from the need to compensate workers for non-monetary aspects of a job, such as difficult working conditions or undesirable locations.

Q2: The sounds of a language are referred

Q9: If a company is considering accepting a

Q20: When using the absorption approach to cost-plus

Q30: Which of the following is an example

Q37: Infant IQ scores from 6-month-olds predict later

Q38: Alley Corporation's vice president in charge of

Q45: (Appendix 5A)Albanese Corporation manufactures and sells one

Q45: (Appendix 12B)The Bolton Company operates a Health

Q54: (Appendix 8C)The release of working capital at

Q124: (Appendix 8C)Foucault Corporation has provided the following