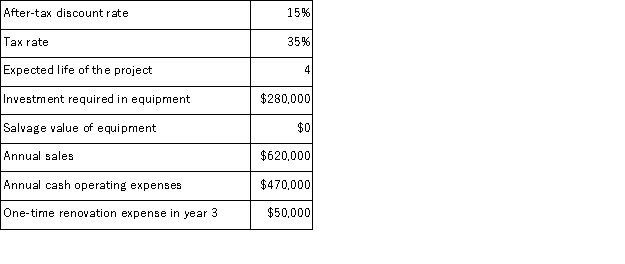

(Appendix 8C) Zangari Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

Definitions:

Sexual Functioning

The ability and capacity to engage in sexual behavior.

Subcortical Structures

Components of the brain located below the cerebral cortex, involved in various functions including emotion, movement, and memory.

Limbic System

A complex system of nerves and networks in the brain, involved in the control of basic emotions and drives, such as fear, pleasure, and anger.

Thalamus

Structure of the brain that directs incoming information from sense receptors (such as vision and hearing) to the cerebrum.

Q2: (Appendix 8A)(Ignore income taxes in this problem.

Q10: (Appendix 6A)Hasty Hardwood Floors installs oak and

Q14: Eighteen-month-old Zach's vocabulary consists mainly of words

Q44: Thurstone and Thurstone's work on intelligence<br>A) emphasized

Q49: Searls Corporation, a merchandising company, reported the

Q53: Krupka Corporation's two products have the following

Q56: Callis Corporation is a wholesaler that sells

Q69: (Appendix 11A)Tillinghast Corporation estimates that its variable

Q77: (Appendix 8C)Hohlfeld Corporation is considering a capital

Q90: According to the _ approach, children use