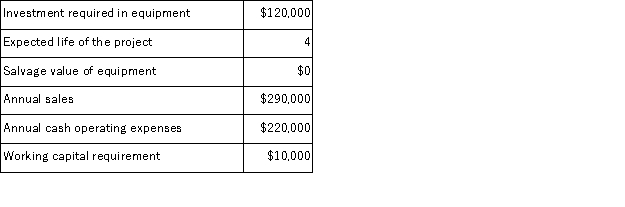

(Appendix 8C) Helfen Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 13%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 35% and its after-tax discount rate is 13%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Treasurer

An officer of a company or organization responsible for managing financial risks, investments, and treasury operations.

Expected Profit

The forecasted gain or loss from a business venture or investment, calculated by multiplying the potential outcomes by their probabilities.

Liabilities

Liabilities are financial obligations or debts that a business has to pay back in the future, such as loans, accounts payable, and mortgages.

Assets

Refers to resources owned by a company or individual that have economic value and can provide future benefits.

Q11: (Appendix 8A)Computing the present value of future

Q19: (Appendix 12A)One disadvantage of using the actual

Q27: Syntax refers to<br>A) the sounds of a

Q30: Which of the following is a culture-fair

Q31: The ability to deal adaptively with novel

Q38: Inspection costs at one of Iuliano Corporation's

Q39: Stereotype threat may explain why European American

Q40: Okamoto Corporation's management believes that every 7%

Q65: Pricing decisions are most difficult in those

Q140: (Appendix 8C)Erling Corporation has provided the following