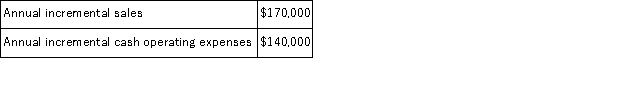

(Appendix 8C)Revello Corporation is considering a capital budgeting project that would require investing $40, 000 in equipment with a 4 year useful life and zero salvage value.Data concerning that project appear below:  An investment of $30, 000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 9%.

An investment of $30, 000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 9%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Lower Class

A socioeconomic group often characterized by low income, limited educational attainment, and restricted access to resources and opportunities.

Formal Education

Education that is structured and provided by formal institutions like schools, colleges, and universities.

Working Poor

Individuals who are employed yet live in conditions of poverty due to low wages and limited work hours.

Forbes 400

An annual ranking published by Forbes magazine of the 400 wealthiest American residents.

Q2: (Appendix 6A)Grogam Catering uses activity-based costing for

Q3: (Appendix 8A)(Ignore income taxes in this problem.

Q7: What is "turn-taking" in language development?

Q10: The interdependence of the members of communities

Q14: (Appendix 2A)Cespedes Inc.'s inspection costs are listed

Q17: Which of the following statements is TRUE

Q33: The highest score an individual can have

Q109: Which of the following would be considered

Q124: (Appendix 8C)Foucault Corporation has provided the following

Q138: (Appendix 8C)Stack Corporation is considering a capital