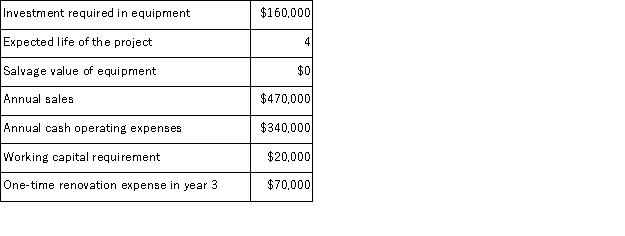

(Appendix 8C) Pont Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Company's Stocks

Equity investments that represent ownership shares in a corporation, giving holders a claim on part of the company's assets and earnings.

Balanced Scorecards

A strategic planning and management system used for aligning business activities to the vision and strategy of the organization, improving internal and external communications, and monitoring organizational performance against strategic goals.

Markets

Places or systems in which goods, services, and financial instruments are traded between individuals, businesses, or entities.

Products

Goods or services offered by a business or manufacturer, created to fulfill the needs and desires of consumers.

Q5: Farnor, Inc. , would like to estimate

Q23: (Appendix 11A)Oldham Corporation bases its predetermined overhead

Q26: (Appendix 11A)A manufacturing company uses a standard

Q27: (Appendix 12B)For performance evaluation purposes, any variance

Q39: (Appendix 8C)Strathman Corporation has provided the following

Q46: Alley Corporation's vice president in charge of

Q74: The management of Lowndes Corporation has provided

Q77: Merced Corporation estimates that an investment of

Q140: (Appendix 8C)Erling Corporation has provided the following

Q174: Comparative income statements for Tudor Retailing Company