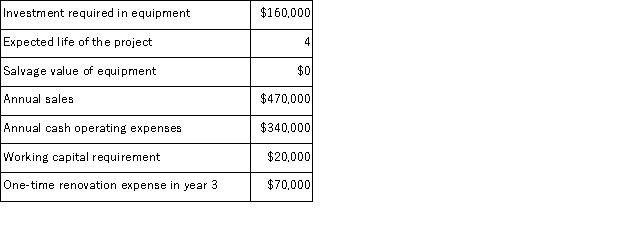

(Appendix 8C) Pont Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

Definitions:

Range Of Motion

The full movement potential of a joint, usually its range of flexion and extension; an important measurement in assessing joint functionality.

Plantar Calcaneonavicular Ligament

A supportive band of tissue found in the foot that helps maintain the arch and provides stability to the foot during movement.

Transverse Acetabular Ligament

A ligament that bridges a notch at the bottom of the acetabulum, contributing to the stability of the hip joint.

Interosseous Membrane

A fibrous membrane connecting the bones of the forearm (radius and ulna) or leg (tibia and fibula), providing stability and support.

Q12: The management of Liess Corporation has provided

Q13: Your friends Tom and Susan have an

Q19: (Appendix 5A)Moffa Corporation manufactures and sells one

Q19: (Appendix 12A)One disadvantage of using the actual

Q30: Up to how much should the company

Q35: (Appendix 5A)Wienecke Corporation manufactures and sells one

Q47: (Appendix 12B)Ideally, the base selected for charging

Q82: The Bayley Scales of Infant Development<br>A) are

Q97: (Appendix 11A)Tropiano Electronics Corporation has a standard

Q104: (Appendix 11A)Dexter Corporation uses a standard cost