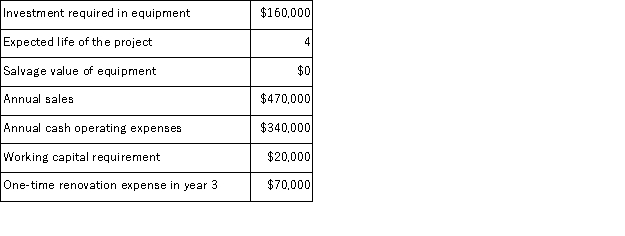

(Appendix 8C) Pont Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

The company's income tax rate is 30% and its after-tax discount rate is 10%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The net present value of the entire project is closest to:

Definitions:

Public Assistance

Government programs designed to provide financial aid, goods, or services to individuals or families in need, often based on income or circumstance.

Employed

refers to individuals who are currently working for pay, either as employees, self-employed, or in their own businesses.

Poverty Rate

The percentage of the population living below the national poverty line, indicating the proportion of individuals with insufficient income to meet basic needs.

Welfare

Government programs designed to support the well-being of its citizens, especially those in financial or social need.

Q2: (Appendix 4B)The management of Cordona Corporation would

Q3: (Appendix 6A)If a cost object such as

Q7: (Appendix 12B)Lopez Company has a purchasing department

Q12: (Appendix 4B)The management of Benedict Corporation would

Q12: (Appendix 5A)Rhoda Corporation manufactures and sells one

Q13: (Appendix 8A)The higher the discount rate, the

Q30: (Appendix 12B)Brosnan Corporation has two operating divisions-a

Q39: Which of the following is positively related

Q57: Merced Corporation estimates that an investment of

Q174: Comparative income statements for Tudor Retailing Company