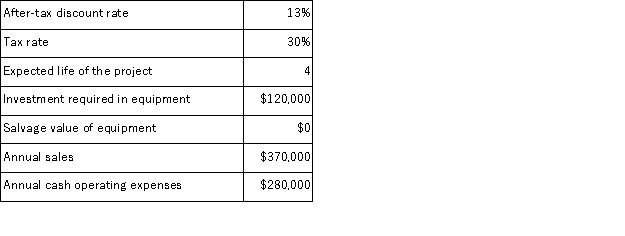

(Appendix 8C) Dekle Corporation has provided the following information concerning a capital budgeting project:  The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 2 is:

The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The total cash flow net of income taxes in year 2 is:

Definitions:

Warren Buffett

An American investor, business tycoon, philanthropist, and the chairman and CEO of Berkshire Hathaway, known for his successful investment strategies.

Average Tax Rate

The percentage of taxable income that is paid in taxes; taxes paid divided by taxable income.

Stock Market Investor

An individual or entity that allocates capital with the expectation of receiving financial returns in the stock market.

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income; the percentage of tax applied to your income for each tax bracket in which you qualify.

Q5: (Appendix 12B)Yacavone Corporation has two operating divisions-a

Q8: Describe infant speech perception during the first

Q26: (Appendix 8C)Gutshall Corporation is considering a capital

Q28: Adding -s and -ing are simple grammatical

Q34: Fast mapping denotes the phenomenon that<br>A) words

Q54: (Appendix 11A)Homer Corporation has a standard cost

Q71: Hannah is a school-aged child. Which of

Q82: (Appendix 8C)Skolfield Corporation is considering a capital

Q93: (Appendix 8C)Blier Corporation has provided the following

Q99: (Appendix 8C)Onorato Corporation has provided the following