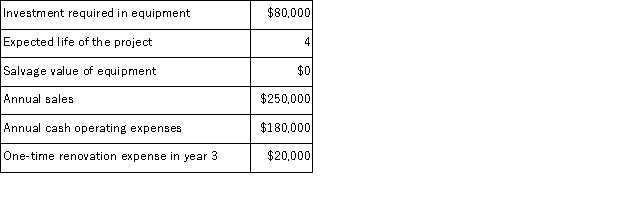

(Appendix 8C) Credit Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

The company's income tax rate is 30% and its after-tax discount rate is 15%.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 3 is:

Definitions:

Common Purpose

Shared goals or objectives that unite individuals or groups in their efforts toward achievement and collaboration.

Courage

The ability to confront fear, pain, danger, uncertainty, or intimidation.

Followership Process

The dynamics and behaviors of individuals in a subordinate role, focusing on how they contribute to the effectiveness of leadership and organizational objectives.

Partner Style

A leadership approach emphasizing collaboration, trust, and mutual respect between leaders and followers.

Q1: (Appendix 5A)Schaadt Corporation manufactures and sells one

Q2: (Appendix 4B)The management of Cordona Corporation would

Q11: What is infant-directed speech and how is

Q33: (Appendix 11A)A company has a standard cost

Q41: (Appendix 11A)Derf Corporation uses a standard cost

Q42: (Appendix 11A)The Murray Corporation makes and sells

Q44: (Appendix 5A)Griffy Corporation manufactures and sells one

Q74: The management of Kizer Corporation would like

Q111: (Appendix 8C)Mitton Corporation is considering a capital

Q113: Frank Company operates a cafeteria for its