(Appendix 8C)Shinabery Corporation Has Provided the Following Information Concerning a Capital

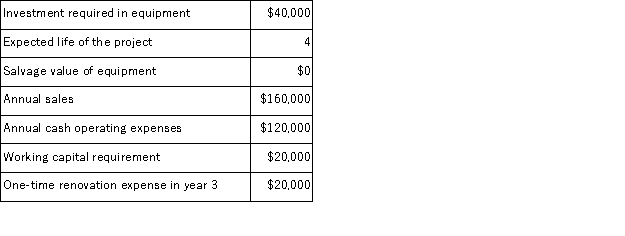

(Appendix 8C) Shinabery Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 9%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 35% and its after-tax discount rate is 9%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Peribrachial Area

Cholinergic nucleus in the dorsal brainstem having a role in R-sleep behaviors; projects to medial pontine reticular formation.

Microsleep

Brief sleep period lasting a second or so.

Sporadic Napping

The act of taking short, unplanned periods of sleep at irregular intervals.

Pseudocoma

A condition in which an individual appears to be in a coma but is actually aware and conscious.

Q4: (Appendix 12B)Service department costs should not be

Q6: (Appendix 12A)Krenski Corporation has a Parts Division

Q7: (Appendix 12A)The Red River Division of Alto

Q7: (Appendix 4A)Kebort Manufacturing Corporation has a traditional

Q10: (Appendix 8C)Boch Corporation has provided the following

Q11: Tests of infant intelligence do not generally

Q32: Children learn general rules about grammatical morphemes.

Q34: If a child knows the word dinosaur

Q36: (Appendix 11A)Stenquist Corporation has provided the following

Q88: Comparative income statements for Tudor Retailing Company