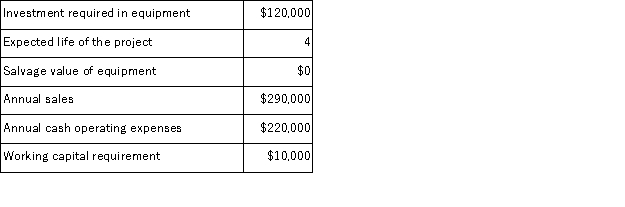

(Appendix 8C) Helfen Corporation has provided the following information concerning a capital budgeting project:  The company's income tax rate is 35% and its after-tax discount rate is 13%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

The company's income tax rate is 35% and its after-tax discount rate is 13%.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting. The income tax expense in year 2 is:

Definitions:

Gifts and Gratuities

Items or payments given voluntarily without payment in return, often as a gesture of goodwill or for promotional purposes.

Commercial Bribery

The unethical or illegal practice of influencing the decisions of business personnel through unauthorised gifts or payments.

Perception of Bias

The belief or view that a person or organization is biased, leading to questions about fairness or objectivity.

Reciprocity

A mutual exchange of privileges or interactions between two parties, often used in trade and negotiations.

Q5: Holding all other things constant, if the

Q6: Children are more likely to learn a

Q15: Young infants cannot discriminate sounds that they

Q17: (Appendix 2A)Donner Company would like to estimate

Q21: (Appendix 2A)The management of Sambrano Corporation would

Q31: (Appendix 12B)Vancuren Corporation has two operating divisions-an

Q33: The use of symbols is not related

Q36: Children with a referential style of learning

Q52: Daisley Products Inc.makes two products-B17U and R94X.Product

Q171: Baker Corporation has provided the following production