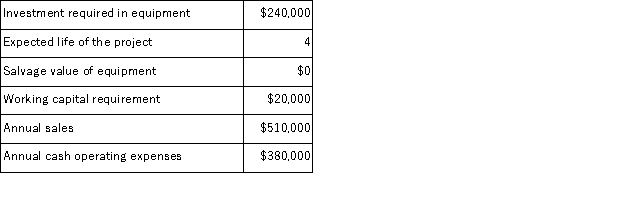

(Appendix 8C)Hothan Corporation has provided the following information concerning a capital budgeting project:  The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $60, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 15%.

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $60, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 15%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Accepting of Diversity

The openness and willingness to understand, respect, and embrace differences among individuals, including ethnicity, gender, age, and more.

Individualistic Culture

A societal framework that emphasizes personal independence and the self over collective goals and community well-being.

Equity Principles

Guidelines that ensure fairness and justice in the treatment and representation of individuals and groups within organizations and societies.

Theories of Organizational Behaviour

A field of study that investigates the impact that individuals, groups, and structure have on behavior within organizations, aiming to apply such knowledge towards improving an organization's effectiveness.

Q3: Your friend Clyde would like his five-year-old

Q12: Management of Childers Corporation is considering whether

Q28: Adding -s and -ing are simple grammatical

Q32: Children learn general rules about grammatical morphemes.

Q40: Developmental dyscalculia refers to<br>A) a difficulty in

Q41: Noel believes that children master grammar in

Q43: (Appendix 8C)Lanfranco Corporation is considering a capital

Q43: (Appendix 11A)Derf Corporation uses a standard cost

Q76: As infants develop,<br>A) babbling shifts from single

Q101: (Appendix 8C)Zangari Corporation has provided the following