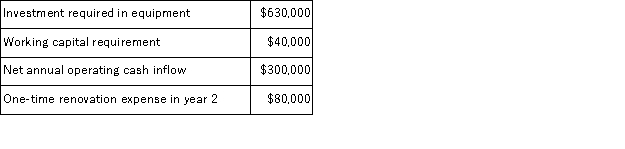

(Appendix 8C)Mota Corporation has provided the following information concerning a capital budgeting project:  The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210, 000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Calcium Ion Influx

A cellular process involving the movement of calcium ions (Ca2+) into a cell, leading to various physiological responses.

Dopamine

A chemical messenger that plays a key role in regulating motivation, reward, and the control of movement.

Metabotropic Receptors

A type of receptor that, when activated, initiates a cascade of metabolic reactions within the cell to indirectly alter its electrical state, often involving G-proteins and second messengers.

Mesolimbic Dopaminergic

Referring to the dopamine pathway in the brain associated with reward, pleasure, and addiction mechanisms.

Q4: When questioning children, interviewers should pursue only

Q7: A child's ability to make connections between

Q7: From early childhood to late adolescence, it

Q25: (Appendix 11A)A manufacturing company uses a standard

Q70: Youngsters with a referential style of language-learning<br>A)

Q71: Hannah is a school-aged child. Which of

Q72: Tansley Corporation has two products that use

Q77: Joanne and Dennis want to do all

Q101: Creativity<br>A) is associated with convergent thinking.<br>B) cannot

Q103: Along with substantially below average intelligence, an