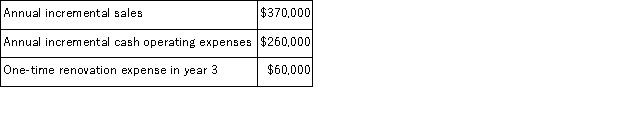

(Appendix 8C)Flippo Corporation is considering a capital budgeting project that would require investing $160, 000 in equipment with a 4 year useful life and zero salvage value.Data concerning that project appear below:  An investment of $20, 000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 6%.

An investment of $20, 000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 6%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Leader

An individual who guides or directs a group towards achieving set objectives by motivating, influencing, and providing direction.

Open-Book Management

An approach to management in which every employee is trained, empowered, and motivated to understand and pursue the company’s business goals.

Strategic Decision

A significant choice made by top-level management that sets the direction and influences the future success of an organization.

Pre-Existing Idea

A concept, belief, or opinion that was formed before the current context or situation.

Q1: Gardner believes that schools should foster all

Q6: (Appendix 8A)(Ignore income taxes in this problem.

Q21: (Appendix 4B)The management of Cordona Corporation would

Q27: Which of the following shows the formula

Q33: Reigel Corporation is about to launch a

Q51: Which of the following is NOT one

Q52: Daisley Products Inc.makes two products-B17U and R94X.Product

Q56: Daisley Products Inc.makes two products-B17U and R94X.Product

Q61: Redshaw Corporation has provided the following data

Q86: (Appendix 11A)Bruley Corporation applies manufacturing overhead to