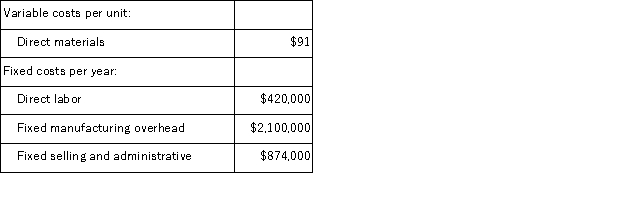

(Appendix 5A)Griffy Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 30, 000 units and sold 23, 000 units.The company's only product is sold for $239 per unit.

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 30, 000 units and sold 23, 000 units.The company's only product is sold for $239 per unit.

Required:

a.Assume the company uses super-variable costing.Compute the unit product cost for the year and prepare an income statement for the year.

b.Assume that the company uses an absorption costing system that assigns $14 of direct labor cost and $70 of fixed manufacturing overhead to each unit that is produced.Compute the unit product cost for the year and prepare an income statement for the year.

c.Prepare a reconciliation that explains the difference between the super-variable costing and absorption costing net incomes.

Definitions:

AIDS

Acquired Immunodeficiency Syndrome, a life-threatening condition caused by the human immunodeficiency virus (HIV), which severely damages the immune system.

Illusory Correlation

A cognitive anitr that describes when people falsely believe that two variables, such as events or actions, are related despite a lack of evidence.

Confirmation Bias

The tendency to search for, interpret, or remember information in a way that confirms one's preconceptions.

Co-worker

A person with whom one works, typically someone within the same workplace or organization.

Q1: Bruno et al (2007) studied the ability

Q6: Compare the advantages of group intelligence tests

Q10: (Appendix 11A)A company has a standard cost

Q15: (Appendix 8C)Broxterman Corporation has provided the following

Q42: In acting as a witness, children should

Q46: According to the rules that young children

Q53: (Appendix 8C)Soffer Corporation has provided the following

Q53: Eakins Corporation has just developed a new

Q77: (Appendix 8C)Hohlfeld Corporation is considering a capital

Q89: Dr. White is a learning theorist who