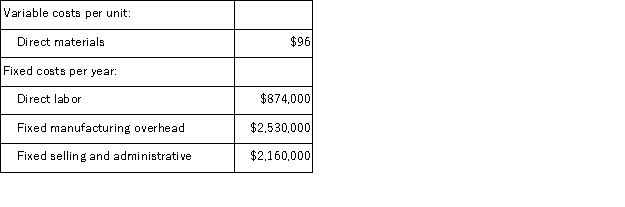

(Appendix 5A) Sirmons Corporation manufactures and sells one product.The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 46, 000 units and sold 45, 000 units.The company's only product is sold for $249 per unit. The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative costs.During its first year of operations, the company produced 46, 000 units and sold 45, 000 units.The company's only product is sold for $249 per unit. The net operating income for the year under super-variable costing is:

Definitions:

Stock Splits

A corporate action where a company divides its existing shares into multiple shares to boost the liquidity of the shares, although the overall value of the company does not change.

Market Price

The present cost at which services or assets are offered for trade in the market.

Extra Dividend

A one-time payment made by a company to its shareholders, in addition to any regular dividends.

Liquidating Dividend

A payment made by a corporation to its shareholders during its liquidation, distributing the remaining assets.

Q3: Gillis Corporation's marketing manager believes that every

Q10: (Appendix 2A)The management of Buff Sports Stadium

Q12: (Appendix 4A)Binegar Manufacturing Corporation has a traditional

Q27: Syntax refers to<br>A) the sounds of a

Q29: Results of massive, continued intervention programs such

Q30: (Appendix 12B)Brosnan Corporation has two operating divisions-a

Q46: Research on the accuracy of children's testimonies

Q53: Gene has discovered that even though he

Q81: Whose score on the Bayley Scales of

Q91: (Appendix 8C)Croes Corporation has provided the following